Our Services.

Chambers Plan

-

Sunlife

-

Canada Life

-

Manulife

Equitable Life

-

Desjardins

-

Empire Life

-

Pacific Blue Cross

-

Victor

-

Benefits by Design

-

Green Shield

-

Chambers Plan - Sunlife - Canada Life - Manulife Equitable Life - Desjardins - Empire Life - Pacific Blue Cross - Victor - Benefits by Design - Green Shield -

Group Extended Health and Dental Benefits

Employees today want more than just a paycheck; they want employers who care about their well-being and their families’ health. Investing in employees’ wellness leads to higher retention and loyalty.

-

To attract and keep employees, businesses should offer a comprehensive group benefits plan. This can include health and dental benefits, wellness programs, and flexible work conditions. These benefits boost employees’ productivity and happiness, and employers can get tax benefits too. Flexible plans allow for cost-effective, customized insurance options.

Benefits offered :

Extended health and dental care coverage

Group life insurance

Group short and long-term disability insurance

Employee assistance and wellness programs

Fully pooled, partially pooled, experienced and ASO

Group critical illness coverage

Group retirement and savings plans

Health Spending Accounts / Private Health Services Plans

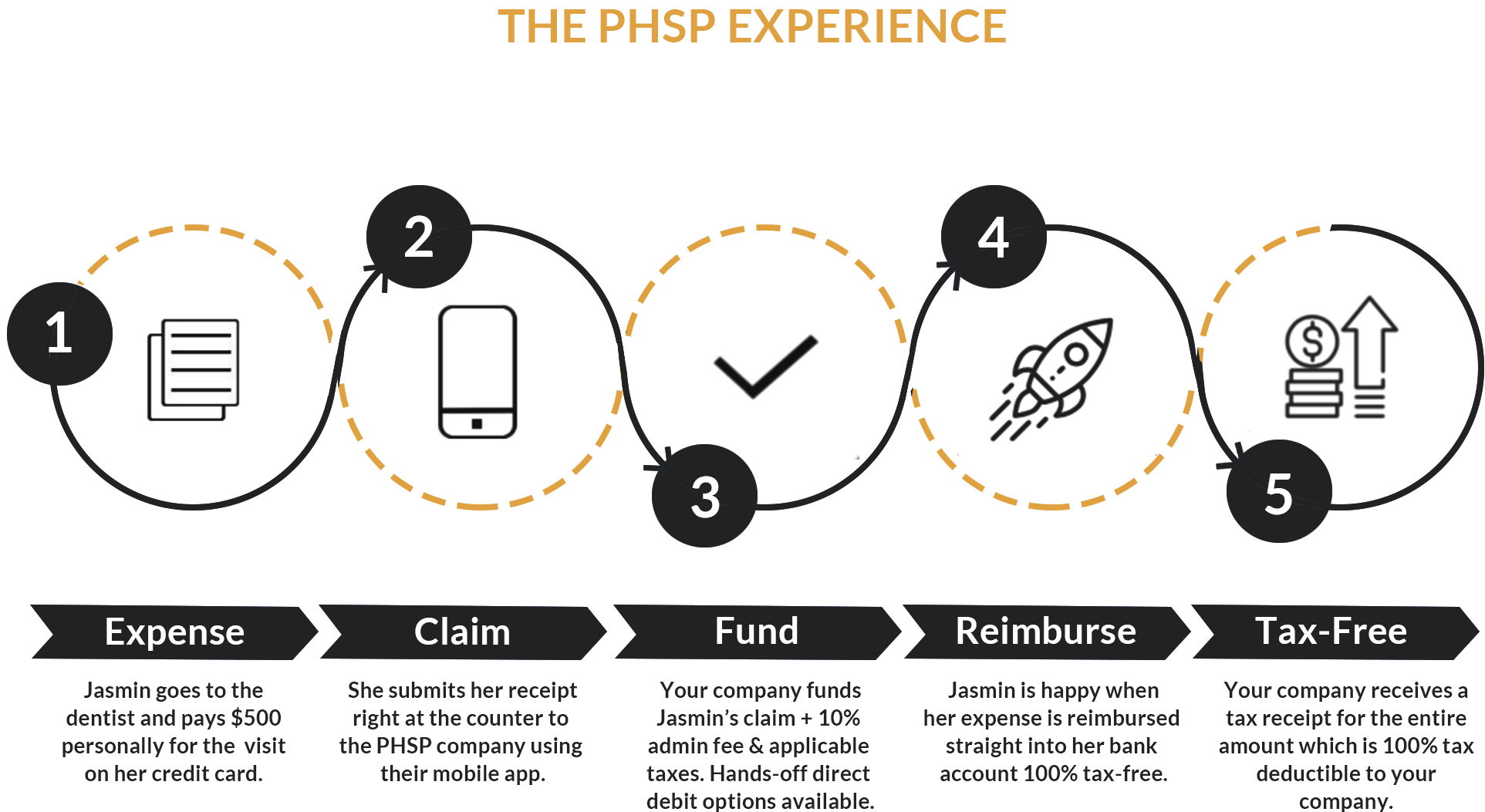

A Private Health Services Plan (PHSP) allows small business owners to turn their medical expenses into tax-deductible costs. It offers flexibility for both employers and employees to cover various healthcare expenses, making it easier to manage these costs.

-

Are you incorporated?

Did you know that you can write off 100% of your health and dental expenses?

Did you know that you can provide a tax-free health and dental benefit to your employees?

Whether it’s complete coverage you need (health, dental, vision, prescription) or whether you want to transfer out some costly coverages from a traditional plan and put them in a PHSP (also known as a Health Spending Account) – we have a solution for you.

Individual Health and Dental Benefits

If you are an employee or a one-person sole-proprietorship that requires extended health and dental only, it’s important to review your options. We work with all of the major carriers to provide solutions.

-

Extended medical insurance generally provides coverage towards additional services that basic medical insurance plans (provincial medical services plans) do not cover such as vision, dental care, and prescription drugs. Are you prepared? The out-of-pocket costs can be significant. Extended health and dental coverage allows you to make smart choices about your family's health and well-being, so your primary focus is on getting them the best treatment and not how you'll pay for it.

Even you are an employee or a one-person sole-proprietorship that requires extended health and dental only, it’s important to review your options. We work with all of the major carriers to provide solutions.

Life Insurance

Life insurance provides financial security for your family after your death. It offers a tax-free lump sum payment that can cover income, final expenses, and debts, giving your loved ones peace of mind.

-

What is the financial impact of an unexpected death? Life insurance provides much needed financial security for your family. It offers a tax-free lump sum payment that can cover income, final expenses, and debts, giving your loved ones peace of mind.

For business owners, life insurance can be structured to provide funding for a number of possible situations, including partnership buy-sell arrangements, business loan repayment and key person protection.

Living Benefits

What happens if encounter a Critical Financial Event? What happens if you are sick or injured and cannot work for a prolonged period? How would you pay your bills?

-

It’s important to explore your options:

Long-Term Disability Insurance

Disability insurance provides financial support if employees can’t work due to injury or illness. While health insurance covers medical costs, disability insurance helps with everyday expenses. Long-term disability (LTD) coverage ensures financial security, allowing employees to focus on recovery and returning to work.

Critical Illness Insurance

Critical illness insurance helps ease the financial burden of a serious illness, complementing disability and life insurance. It provides financial security so you can focus on recovery.

Benefits include:

Coverage up to 25 conditions

A lump-sum payment for any use, like mortgage or medical treatment

Home-care costs during illness and recovery

Payments even if you’re not disabled from working

Optional return of premium benefit

Business Overhead Insurance

The death of a business partner or major stockholder can greatly impact both the business and the surviving family. The business needs to buy the deceased partner’s share at a fair price to continue smoothly, while the family wants capital for their interest, which may help settle the estate.

Income is crucial for daily expenses and future financial security. Losing your income due to illness or disability can have serious consequences.

Financial Planning

Financial planning is a process – We ask questions that, together, help us create a dynamic plan as the needs of our clients change. We call it the myGateway FORMula. It helps clients create, grow, protect and transfer their wealth.

-

We start with questions like:

Where are you starting from?

Where do you want to go?

These questions lead to finding out the best way to get there.